Banking

Banking and financial domain testing is a process of verifying the functionality, performance, and security of applications that are related to the banking and financial services industry (BFSI). This can include transferring and depositing funds, balance inquiries, transaction history, and withdrawals.

BFSI applications are often complex, with many different layers and components. Testing these applications can be challenging, but it is essential to ensure that they are functioning correctly and securely.

Banking and financial domain testing can help to identify issues that could impact customers or cause financial losses. It is therefore an important part of ensuring the quality of BFSI applications.

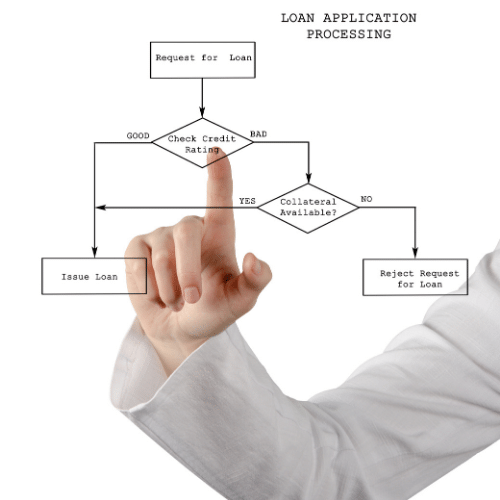

Testing Process

Banking domain testing is a process of testing software applications that are related to the banking industry. This type of testing is important in order to ensure that these applications are functioning properly and securely. Some of the characteristics of banking domain testing include:

-Thoroughness: Banking domain testing must be thorough in order to find all potential issues with an application. All aspects of the application must be tested, including its interface, security, and performance.

-Detail-Oriented: Testing in the banking domain requires attention to detail in order to identify all potential problems. banker needs to understand how the application works in order to effectively test it.

-Security-Focused: Security is a major concern for any software application, but it is especially important in the banking domain. testers need to be sure that an application is secure before it can be used by banks or their customers.

-Independent: Banking domain testing should be done by an independent party in order to ensure impartiality. The results of the tests should not be influenced by any outside factors.

Challenges

Banking applications are among the most critical and complex applications to test. They must meet stringent requirements for security, performance, and reliability. Testing challenges in banking applications include replicating test data, managing DB migrations, testing functional and non-functional requirements, ensuring the system follows the desired policies and procedures, and performing integration and compatibility testing.

-Replicating test data is a challenge because of the sensitivity of the data and the need to maintain data privacy. Data privacy concerns can make it difficult to create realistic test data sets that accurately reflect production data.

-DB migrations are another challenge because they can introduce errors that impact application performance or functionality.

-Functional testing is essential to ensure that banking applications meet their required functionality but can be challenging due to the complexity of the applications.

-Non-functional testing is also important to ensure that banking applications meet performance, scalability, and security requirements.

-Policies: Ensuring that the system follows the desired policies and procedures is another key challenge in testing banking applications.

-Integration testing is necessary to ensure that all components of the banking application work together as intended.

-Compatibility testing is also important to ensure that the banking application works with the other systems it must interface with, such as accounting or customer relationship management (CRM) systems.

DragonFlyTest: Why should you use it

- Ensures that the application is secure and does not have any vulnerabilities that could be exploited by hackers

- Helps to identify any bugs or errors in the code that could cause problems when the application is used in a live environment

- Minimize the risk of security breaches or disruptions to their operations

- Ensure that customer data and money is safe

- Make sure application are secure and can withstand attacks

- Protects the bank’s reputation and customers’ trust.

- APIs for Open Banking

- Banking CRM for Retail and Digital Banking

- Platforms for digital card payments

- Cloud-Based Banking Services

- Batch and real-time processing

- Strong auditing to fix existing issues

- Integrating Voice and Chatbots in Banking Systems

- Ensure that your banking apps are compliant with relevant standards

- Core Banking Product Migration